Do you transfer money abroad regularly as part of your business operations? It could pay off to reassess the services you use, in turn helping your bottom line. With more digital payments worldwide and an increasingly competitive payments provider space, it’s time to find the best solution to your cross-border transfers.

How to select a good payment provider?

As a business, you want your operations to be as streamlined as possible. Every minute spent configuring international transactions is a minute you could spend doing something else.

Choosing an international payments partner requires a deep dive into your own requirements. These can sound like:

- Which countries do I need to send money to?

- Do I need to have currency conversions first - and if so, how accurate do they need to be to the market rate?

- What are my payment volumes?

- How many transfers do I plan to do in a week, month, year?

- How quickly do payments need to go through?

It’s also important that your provider or platform follows international taxation and monetary regulations, and has a good reputation.

How to identify good money transfer fees upfront?

International payment providers have a range of different fee structures, which can be confusing when you’re trying to make comparisons.

Some common payment fee structures include:

- A flat fee per payment

- A percentage of the payment amount

- A flat fee plus a percentage of the payment amount

- A flat monthly fee

There may also be clauses that affect these fees either by them increasing or decreasing, including:

- If payments need to be expedited

- Whether there are specific single payment thresholds

- In the instance there are cumulative payment thresholds

- If there are a certain number of payments allowed in a given period

Do be aware that banks and other payment providers may not offer market rates (or even the rates close to it) for currency conversions. If this is a concern for your business, then the market rates should be accounted for under the fees section. You can compare different currency pairs to the market rate to see how they differ.

How to choose is personal

For some businesses, it’s about finding a global payment provider or platform that has a basic, easy-to-understand fee structure that they promise won’t change. It’s about hunting for integrity and transparency over the overall fee costs. For other businesses, it’s about doing the calculations and finding the absolute best provider based on the execution speed or exotic currencies offering.

How long can payments take?

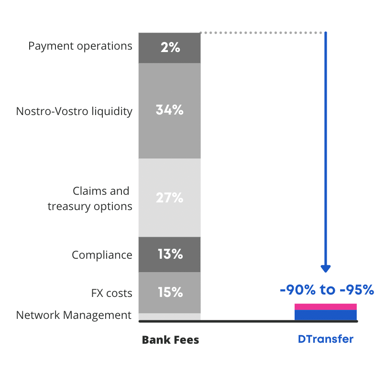

While you may be accustomed to settlements for international transfers taking days to even weeks, this doesn’t have to be the case. Modern technology allows that means international payments can be made near-instantly, whether currency conversions are made or not. You will need to check that near-instant payment offerings do not have exorbitant fees. Blockchain-based services such as DTransfer allow sending money at a fraction of a regular fee price.

What different payment methods are used?

The technologies in place to do international transfers vary. These include methods such as wire transfers, ACH, SEPA, Visa and Mastercard, PayPal, and Stripe. Each of these methods may only work in certain regions or between certain countries or even between certain financial institutions.

A global payments platform can save you a lot of money on international transfers by allowing you to send money internationally using various payment methods other than a wire transfer.

Instead of coordinating multiple different international payment methods in-house, look to a payments platform that does it all.

Setting up recurring payments - internally and externally

Whether it’s paying your staff their salaries into their overseas bank accounts or paying bills to an offshore provider, recurring payments need to be configurable as part of your provider’s platform. After all, the more you automate, the more time you save.

Talk to DTransfer

We’re one of the new breeds of international payments providers offering businesses near-instant payments with low fees and market-rate exchanges on currencies. Talk to us at DTransfer about how we can help you do international business with less friction.