What’s the cost of doing international business? Pretty high, if you’re going through traditional banking avenues. Banks are charging customers a pretty penny to perform international payments, which can even increase the more transactions they do - but where does all that money go and why?

Payment revenues from international transactions added up to no less than $224 billion globally in 2019, according to The 2020 McKinsey Global Payments Report. This equates to a total of 22.4% of global transaction revenues, even though only 11% of global transactions are cross-border transactions.

So why the large imbalance?

It’s a combination of opaque, historical systems with bank ownership:

- A network of trusted parties

- Regulatory approvals

- Tech infrastructure

- Liquidity

Plagued by heavy, legacy systems for conducting international payments, fees run high.

The root cause of international transfer high fees

Let's take a look at how international transaction fees emerge.

Source: Global Payments Report, McKinsey

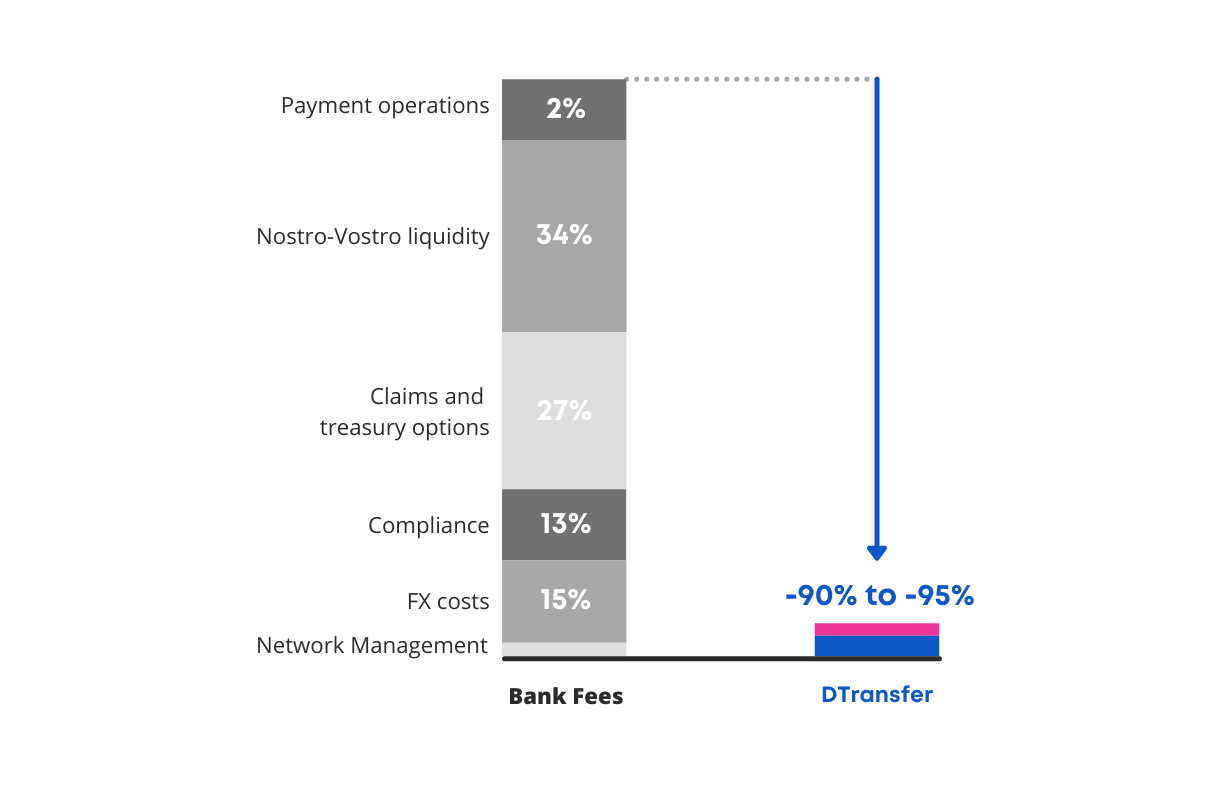

The fees surrounding international transfers are made up of several different aspects, many of which derive from the lack of standardization and general fragmentation within banking networks. The two most significant fee accumulators are claims and treasury operations and nostro-vostro liquidity. Together, they make up more than 50% of the fee structure. Highly complex pricing rules between banks mean that there are various manual invoicing, claims, and dispute activities that require significant backend human resources. Furthemore, without real-time visibility across the transfers process to examine balances and rates, trapped capital costs are higher, and make up the largest percentage of the international transfer fee. All together, complex operations and a lack of continuity are to blame for the high price that you see before you send an international payment.

Taking a look at US and EU banks’ international payment fees

A major US bank’s international fees

One of the biggest banks in the US operates with the following international wire transfer fee structure for their business checking accounts:

- Banker-assisted transfer USD to foreign currency: $50

- Online transfer USD to foreign currency: $40

- Online transfer USD via bank’s exchange < $5000: $5

- Online transfer USD via bank’s exchange > $5000: $0

A major European bank’s international fees

One of Europe’s largest banks, located in the UK, offers the following fee structure for international payments:

- Electronic European payments via SEPA: £24

- Payment by cheque: £11

- Payment by internet banking: £17

- Payment by phone banking: £20- £30

A better alternative

While traditional banking systems are plagued with inefficiencies at every step, modern international payments solutions built on blockchain are by design, low-cost, near-instant, and borderless. Most also offer a highly transparent system to track transactions.

DTransfer offers a better way for businesses to do daily, weekly, and monthly international payments. Our transaction fees run at 90-95% less than traditional bank transfers, with payments made in one currency automatically converted to another.

Do business internationally without the stinging bank fees. Chat with us now to learn more and set yourself up for the future.